In today’s fast-paced financial ecosystem, digital payment solutions are revolutionizing the way businesses and individuals handle transactions. With the rapid evolution of fintech innovations, companies are now prioritizing financial efficiency, security, and scalability. One of the most critical aspects of this transformation is the emergence of crypto custody solutions, ensuring secure and seamless management of digital assets. This article explores how digital payment solutions enhance financial efficiency and why crypto custody solutions are essential in the evolving digital economy.

The Evolution of Digital Payment Solutions

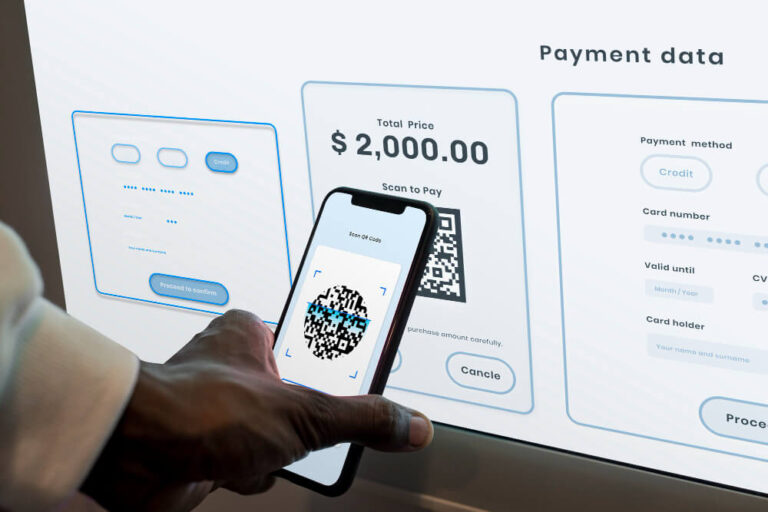

Digital payment solutions have evolved significantly over the past decade, transitioning from traditional banking methods to more sophisticated and technology-driven alternatives. From mobile wallets and contactless payments to blockchain-based transactions, digital payments are redefining financial interactions. Businesses and consumers now rely on these solutions for their speed, convenience, and cost-effectiveness.

One of the most notable shifts in this space is the adoption of cryptocurrencies and blockchain technology. With increased demand for digital assets, secure storage and transaction methods have become paramount. Crypto custody solutions offer an innovative way to manage digital currencies, ensuring robust security and compliance with financial regulations.

Enhancing Financial Efficiency with Digital Payments

Financial efficiency is crucial for businesses striving to reduce operational costs, streamline transactions, and enhance security. Digital payment solutions contribute to financial efficiency in several ways:

1. Faster Transactions

Traditional banking systems often involve delays due to intermediaries and manual processing. Digital payments, especially those powered by blockchain, enable real-time settlements, reducing processing times and increasing liquidity.

2. Reduced Transaction Costs

By eliminating intermediaries, digital payment solutions significantly cut down transaction fees. Businesses can save on costs associated with credit card processing and wire transfers, ultimately improving their bottom line.

3. Improved Security and Compliance

Security is a primary concern in digital transactions. Crypto custody solutions provide an added layer of protection by ensuring that digital assets are stored securely in regulated environments. This reduces the risk of fraud, cyber threats, and unauthorized access.

4. Automation and Smart Contracts

Automation plays a significant role in improving financial efficiency. Smart contracts, powered by blockchain, execute transactions automatically when predefined conditions are met. This reduces manual intervention, minimizes errors, and enhances transparency.

5. Seamless Cross-Border Transactions

For businesses operating globally, cross-border transactions can be expensive and time-consuming. Digital payment solutions facilitate seamless international payments, reducing currency exchange costs and ensuring quick settlements.

The Role of Crypto Custody Solutions in Digital Payments

As cryptocurrencies gain mainstream adoption, businesses and institutional investors require secure methods to store and manage digital assets. Crypto custody solutions play a crucial role in ensuring the safety of funds, providing advanced security features, and maintaining regulatory compliance.

Key Benefits of Crypto Custody Solutions:

- Enhanced Security: Custodial solutions use multi-signature wallets, encryption, and cold storage to protect digital assets from hacking and cyber threats.

- Regulatory Compliance: Licensed custodians ensure compliance with financial regulations, making it easier for businesses to navigate the evolving legal landscape.

- Institutional Adoption: Financial institutions and hedge funds require reliable custody solutions to integrate cryptocurrencies into their investment portfolios.

- Insurance Protection: Some custodians offer insurance coverage for digital assets, mitigating risks associated with theft or loss.

Future Trends in Digital Payment Solutions

The financial landscape is continually evolving, and digital payment solutions will continue to drive innovation. Some key trends to watch include:

- Central Bank Digital Currencies (CBDCs): Governments worldwide are exploring digital versions of fiat currencies to enhance financial inclusion and efficiency.

- DeFi and Decentralized Payments: Decentralized finance (DeFi) platforms are revolutionizing lending, borrowing, and trading through blockchain technology.

- AI and Machine Learning: Advanced AI-driven fraud detection and risk assessment tools will enhance the security of digital payments.

- Tokenization of Assets: Beyond cryptocurrencies, digital payment solutions will facilitate the tokenization of real-world assets, such as real estate and stocks.

Conclusion

Maximizing financial efficiency is a priority for businesses and individuals in the digital economy. Digital payment solutions, coupled with crypto custody solutions, provide a secure, cost-effective, and scalable way to manage transactions. As the fintech landscape continues to evolve, embracing these innovations will be crucial for staying ahead in an increasingly digital world.

By leveraging the latest advancements in digital payments and secure asset management, businesses can enhance their financial strategies, improve operational efficiency, and prepare for the future of finance.